Owning a small business can be exciting and fulfilling, but also a very challenging road to travel. From meeting customer demands to managing employees to overseeing daily operations, owners of small businesses have numerous responsibilities to juggle. But one of the most consequential aspects, one that can be make or break for a business, is financial management.

Unfortunately, most small business owners get this very wrong or they manually carry out this process which is overwhelming, inefficient, and error-prone. Fortunately, a powerful yet user-friendly solution exists in the form of technology—QuickBooks. In this comprehensive guide, we will walk you through how QuickBooks for small business can help simplify your finances, save you precious time, and provide you with the tools to expand your business with confidence.

Importance of QuickBooks for Small Businesses

Regardless of how big your business is, money management and finances are vital to the long-term viability of a business. Ineffectively managing your finances can lead to missing tax deadlines, cash flow problems, and inaccurate financial records, which can be highly expensive mistakes. And that’s where QuickBooks steps in.

QuickBooks for small business simplifies accounting tasks to allow business owners to efficiently track expenses, manage payroll, generate financial reports and file taxes, all in one place. QuickBooks is a game changer whether you are a fresh startup or a fast growing business.

What is QuickBooks and How Does it Work?

Intuit, maker of the QuickBooks line of accounting software, designed the application with small business owners in mind, facilitating automation to help with accounts and financial matters. Arguably the most popular small business accounting software, it’s available in two editions: QuickBooks Online and Desktop.

Quick Books Online uses a cloud-based platform and is good for business owners who need flexibility to access their financial data wherever they are. Whether you have people working remotely or you are a frequent traveler yourself, Quick Books Online allows you to manage your finances wherever you are.

On the other hand, QuickBooks Desktop is a legacy version that is downloaded to one device, making it best for companies who do not need the same flexibility cloud-based software offers.

QuickBooks for Small Business

How to start with QuickBooks? It’s simple. First, select the plan that meets your business’s needs. Several of the QuickBooks plans come with a free trial, allowing you to test the software and see if it’s right for you before you commit.

After picking a plan, you’ll follow set-up prompts to connect your bank accounts, credit cards and other payment systems. QBO Tutorials As we mentioned at the beginning; You will master quickly because QuickBooks provide you tutorials to help you get the hang of it.

QuickBooks Case Study: Small Café in Their Journey

Let’s say a small café owner called Sarah. When she was operational, soon setting up a coffee shop, she recorded all receipts and expenditures manually, pen-on paper, in a ledger. But as her café became more successful and people kept coming, Sarah found it harder and harder to remember the details. That’s when she decided to transition to Quick Books Online.

QuickBooks did more than just automate her tracking of monthly transactions; it organized expenses by category, prepared her tax reports, and cut down the hours she spent reproducing the same busywork manually. With extra time at her disposal, Sarah could devote energy to what she liked best: serving her customers and building her café.

Key Benefits of QuickBooks for Small Business

Quick Books has a few key benefits for small business owners to help to make accounting tasks easier and allow for time to be saved. This automation capability is one of the biggest benefits. By linking your bank account and credit cards, Quick Books automatically imports transactions and categorizes them to help you reconcile accounts.

By automating these tasks, business owners can save time and effort on manual data entry, while reducing the likelihood of human error ensuring that their financial information is current and accurate.

Time-Saving Automation

Quick Books isn’t merely a tool; it’s a time saver! QuickBooks does the heavy work for you instead of entering each transaction manually. After you link your accounts, the program brings in transactions, organizes spending and reconciles your accounts automatically.

These automations can save you significant amounts of time spent on accounting details, so you can focus on growing your business, not drowning in accounting paperwork.

Accuracy Improvement with Decreased Errors

We are all human, and human errors are going to occur, especially in migrating financial transactions manually from one file to another. By automating these processes, Quick Books reduces the risks of errors and inaccuracy of your data. One such application is Quick Books, as accurate financial records are imperative to successful business decisions, and with Quick Books, your data is always up to date.

Tax Season Made Easy

Tax season is one of the most stressful parts of operating a small business. Fortunately, much of the stress when it comes to tax preparation is taken out of the equation with Quick Books. The software logs deductible expenses automatically, produces tax-related reports, and syncs with tax filing software. This makes tax season much easier and less time-consuming and saves you from potentially costly errors.

The Best Features of QuickBooks That Help You Manage Your Finances

Small businesses can benefit from the many features of QuickBooks. These components can vary widely, including expense tracking, invoicing, payroll management, financial reporting, and so on, so you should consider which aspects of your financial processes you’d like a program to streamline.

Expense Tracking

Expense tracking is an essential component of sustaining a good cash flow. With Quick Books, you can connect your business’s bank accounts and credit cards, and the software can automatically import and categorize transactions. What this real-time tracking does is make sure that you are never missing out on any expense that you incur, which in turn makes it easier for you to track your finances.

Generating Invoices and Processing Payments

QuickBooks makes the invoicing process easy with templates that can be customized when creating professional invoices. It allows you to customize it with your business logo, define payment terms, and add due dates. QuickBooks also allows you to accept online payments, which can speed up the cash flow of your business and get faster payments from your clients.

Financial Reporting

Sound financial reports are critical to making informed business decisions. It includes reports like Profit and Loss Statements, Balance Sheets, Cash Flow Reports, etc. There are automatic generation of these reports so you can save time and the effort you would spend on creating them manually. You can access this information with just a handful of clicks, giving you critical insights into the financial health of your business.

Payroll Management

But payroll can be a time-consuming and complicated process for small businesses with employees. If you need payroll system to keep track of your income, Quick Books is the way to go. Direct Deposit enabled Simple And Easy employee payment.

Tax Preparation and Filing

Quick Books also organizes all your financial records in one place and assists small businesses during tax season. It’s great for generating tax-related reports and integrates with tax-filing software, so you can make sure your taxes are filed accurately and on time.

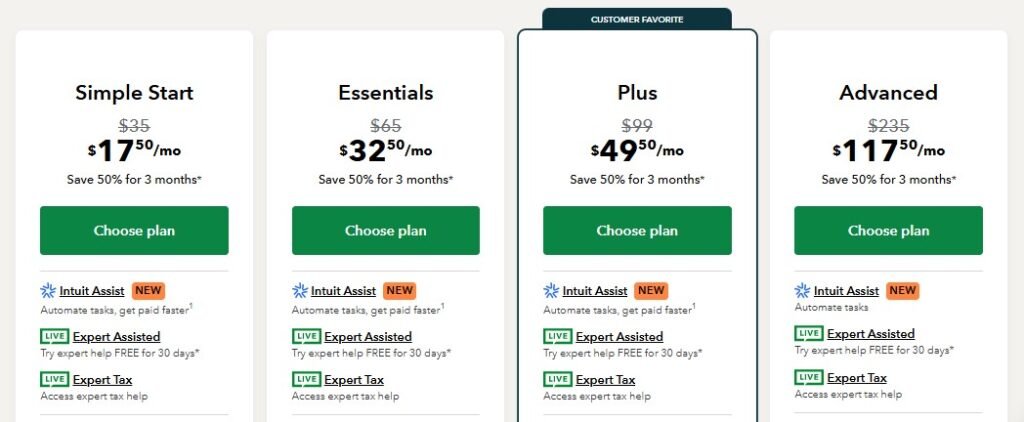

QuickBooks Pricing Plans

QuickBooks provides multiple tiers of pricing to suit businesses in various stages of growth. The Simple Start plan costs $25 per month and is built for freelancers and solo entrepreneurs. If you need more features for your business, the Essentials plan provides bill management and time tracking for $50 a month.

The Plus plan, which costs $80 a month, is geared toward growing businesses, offering everything from inventory tracking to project management. The last option is the Advanced plan that costs $180 per month and offers advanced reporting and dedicated customer support to greater businesses.

How QuickBooks Helps in the Growth of the Business

As your business expands, so will the complexity of the financial management you need to deal with. It can easily grow with your business and even has advanced features, such as multi-currency support, customizable reports and advanced inventory management.

Moreover, Quick Books also integrates with other business solutions, including CRM systems and eCommerce platforms, enabling it to serve as a one-stop shop for managing all your operations.

QuickBooks vs. Other Accounting Software

Xero, FreshBooks, and Wave are some other accounting software you can consider but QuickBooks generally has a wider selection of features and is easier to navigate. Whereas some competitors offer just one or two tools, this accounting software features a full suite of small-business-designed tools — from payroll to inventory management to tax preparation.

Plus, QuickBooks has a well-established background of reliability and amazing customer assistance, which is why it continues to be one of the best accounting software solutions for small business owners.

You can also read our article on ‘Sage vs QuickBooks’ and ‘Zoho Books vs QuickBooks’.

Is QuickBooks Worth It for Small Business?

QuickBooks is a powerful tool that can change the way that you manage your money when it comes to your business. That means it’s not only accounting software; it is integrated business management software that can help you streamline your financial operations and prompt efficiency.

For owners of small businesses, it is essential to have a system they can rely on for everything from invoices to taxes! You get this and much more with this accounting software, an automated solution that lets you give attention to what matters most — scaling your business.

Automation is one of the major advantages of this accounting software. Rather than wasting time entering data manually, it sorts transactions, computes taxes, and produces reports automatically. This makes it faster as well as minimising the chance of human error. This tool takes care of your finances accurately and efficiently, allowing small business owners to focus on other essential aspects of their business.

Furthermore, it makes easy to file taxes, which is a task that can sometimes feel like a massive burden. Organizing your financial data during the year ensures that you are always ready for tax season. You can also produce comprehensive reports that summarize your income, expenses, as well as deductions, helping you to file taxes accurately and avoid expensive errors.

For small businesses in competitive industries, it is crucial to keep on top of tax deadlines and requirements, and Quick Books helps make sure your business remains compliant and efficient.

QuickBooks also helps you with the managing of your business by allowing your financial health and situation to be laid out in front of you. The software includes customizable reports that help you monitor cash flow, profit margins and other key performance indicators.

No matter if you’re a freelancer with no previous experience or the owner of a growing café or eCommerce store, these insights help you better price your offerings, manage stock, and plan for investment in the future. It does not only helps you manage your finances but it also plays a role in shaping the future of your business with better, data-driven decisions.

Apart from the financial features, QuickBooks also integrates with other key business tools. No matter if you use PayPal, Square, or your bank’s online payment platform, QuickBooks easily syncs to those systems, so all your financial data can be brought together in one place.

This automation saves valuable time and ensures no manual input is needed for all your accounts to update. This integration is a boon for small businesses that strive for enhanced operational efficiency.

All in all, QuickBooks is so much more than simply an accounting necessary; it’s succeeding business management software that makes the tools and support that small business owners deserve.

QuickBooks enables businesses to remain organized and prioritize growth by automating tasks, reducing errors, facilitating tax filing, and providing business financial insights. Whether you’re a solo business owner or running a growing team, QuickBooks is well worth the investment for any small business looking to streamline operations and lay a solid financial foundation.

Want to explore more accounting software for small business in US? Click Here to read ‘Best 6 Accounting Software for Small Business in USA’

FAQs

What is QuickBooks and how does it work?

QuickBooks is an accounting software by Intuit helps small businesses manage their finance. It also automates various tasks such as expense tracking, payroll management, financial report generation, and tax preparation, freeing up business owners to focus on other aspects of their operations while minimizing mistakes.

What are the differences between QuickBooks Online and Desktop?

QuickBooks Online is the cloud-based version that you can access from anywhere while QuickBooks Desktop is the traditional software version installed on a local machine. The features for both versions are pretty much the same; however, QuickBooks Online offers greater flexibility and remote access when needed.

How can QuickBooks help with tax filing?

Yes, QuickBooks can assist you in filing your taxes by helping you organize your financial data, create reports, and manage deductions. The software can even track your deductible expenses, helping you minimize your tax liability. It also shows you how QuickBooks integrates with tax filing software to make the process easier.

Does QuickBooks automate certain accounting tasks.

QuickBooks connects with your bank accounts and credit cards, so it can automate your accounting process. It instantly pulls in transactions, categorizes them, and reconciles your accounts. The software also creates financial reports which will save you time and minimize the chance of human error.

Which are the primary characteristics of QuickBooks for small business?

Some key features of QuickBooks are expense tracking, invoicing, payroll management, financial reporting, and tax preparation. These functions assist business owners in managing their finances, ensuring correct documentation, and making tax filing easier.

Is QuickBooks easy to use?

Yes, QuickBooks is simple and made to be beginner-friendly. It provides tutorials and guides to help new users get used to it as quickly as possible. Its easy user interface means even the least cost-savvy can make use of it.

Do I use QuickBooks to track inventory for my business?

Yes, QuickBooks includes inventory tracking in its business to business Plus and Advanced plans. It enables businesses to better manage stock levels, keep a record of sales, and optimize their inventory management process to ensure that they can always have a product available and avoid stockouts.

Which businesses are the best fits for using QuickBooks?

QuickBooks is great for all sorts of small businesses, such as freelancers, e-commerce stores, cafés, and service providers. This is also great for companies that want to automate their financial systems so that they can input fewer figures, make fewer mistakes, and save time.

How much does QuickBooks cost? Which plan is right for me?

QuickBooks has multiple pricing plans, which range from as low as $25 per month for the Simple Start plan to $180 per month for the Advanced plan. The plan you select will depend on the needs of your business, such as the number of employees, the complexity of your financial operations and whether you require advanced features such as inventory tracking.

If I need assistance, does QuickBooks provide customer service?

Yes, their support team can help with setup, troubleshooting, or questions about using the software

1 Comment